How much do people use Social Media?

Facebook has 1.2 billion active users. BI Intelligence recently calculated an Engagement Index for top major social networks and compares their performance in terms of time-spend terms per-user, on desktop and mobile.

Here are the findings on Social Media Usage:

- Social is now the top Internet activity: Americans spend an average of 37 minutes daily on social media, a higher time-spend than any other major Internet activity, including email.

- Social-mobile rules: 60% or so of social media time is spent not on desktop computers but on smartphones and tablets.

- Facebook has a monster lead in engagement: Facebook is a terrific absorber of audiences’ time and attention, 114 billion minutes a month in the U.S. alone, on desktop PCs and smartphones. By comparison, Instagram commands 8 billion minutes a month, and Twitter just 5.3 billion.

- Facebook attracts roughly seven times the engagement that Twitter does, when looking at both smartphone and PC usage, in per-user terms.

- Snapchat is a smaller network than WhatsApp, but outpaces it in terms of time-spend per user.

- Pinterest, Tumblr and LinkedIn have made major successful pushes in 2013 to increase engagement on their mobile sites and apps. The new race in social media is not for audience per se, but for multi-device engagement.

- Multi-device social media: Our analysis is based on BI Intelligence’s social media Engagement Index, which compares the effectiveness of social networks in keeping individual users engaged across smartphones and desktop PCs (for an explanation of the Index, sign up for instant access to BI Intelligence).

Each social media platform has cultivated a unique identity thanks to the demographics of the people who participate in the network. Some platforms are preferred by young adults, who are most active in the evening, others by high-income professionals, who are posting throughout the workday.

Here are some of the surprising findings on Demographics of Social Media Usage:

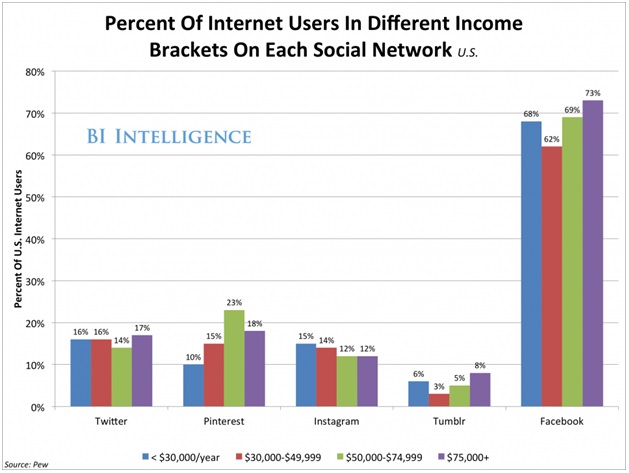

- Facebook still skews young, but the 45- to 54-year-old age bracket has seen 45% growth since year-end 2012. Among U.S. Internet users, 73% with incomes above $75,000 are on Facebook (compared to 17% who are on Twitter). Eight-six percent of Facebook’s users are outside the U.S.

- Instagram: Sixty-eight percent of Instagram’s users are women.

- Twitter has a surprisingly young user population for a large social network — 27% of 18 to 29-year-olds in the U.S. use Twitter, compared to only 16% of people in their thirties and forties.

- LinkedIn is international and skews toward male users.

- Google+ is the most male-oriented of the major social networks. It’s 70% male.

- Pinterest is dominated by tablet users. And, according to Nielsen data, 84% of U.S. Pinterest users are women.

- Tumblr is strong with teens and young adults interested in self-expression, but only 8% of U.S. Internet users with incomes above $75,000 use Tumblr.

Other Interesting facts about Social Media World Wide:

- Facebook still has the largest user population at 1.16 billion monthly active users. But it’s seldom-discussed that YouTube is close behind with 1 billion MAUs.

- China’s giant social media network, Qzone, is running in third place at 712 million total users. It’s twice as large as global social messaging app WhatsApp, and nearly three times as large as Twitter.

- Three of the world’s top 10 social properties are messaging platforms: WhatsApp, LINE, and WeChat.

- IPO-bound Twitter is smaller than many of its less-known rivals, including Tumblr, WhatsApp, and LINE.

- Eighty-six percent of Facebook’s users are outside the United States.

- Facebook has 95 million users in China (despite the fact that it’s officially blocked), 68 million in India, 42 million in Brazil. Taking these population together, they’re twice as large as Facebook’s U.S. population of 100 million.

- Nearly 25% of LinkedIn’s users are in India. In fact, there are more Indians than Americans on LinkedIn and Google+.

- Despite being blocked in China, the major social networks still have many millions of Chinese active users who use various stratagems to access these services. Google+ has 100 million users in China, Twitter has 80 million, and YouTube has 60 million.

- LinkedIn, the only major social network that is not blocked in China, has over 20 million users in the country.

- Asia-Pacific overall has more active social media users than any region, and Southeast Asian markets are off the charts when it comes to mobile social media usage. Eighty-two percent of Thai smartphone owners access social media daily on their phones.

Read more: http://www.businessinsider.com/social-media-engagement-statistics-2013-12#ixzz2q2drakJ8